Passive investing that

actually works.

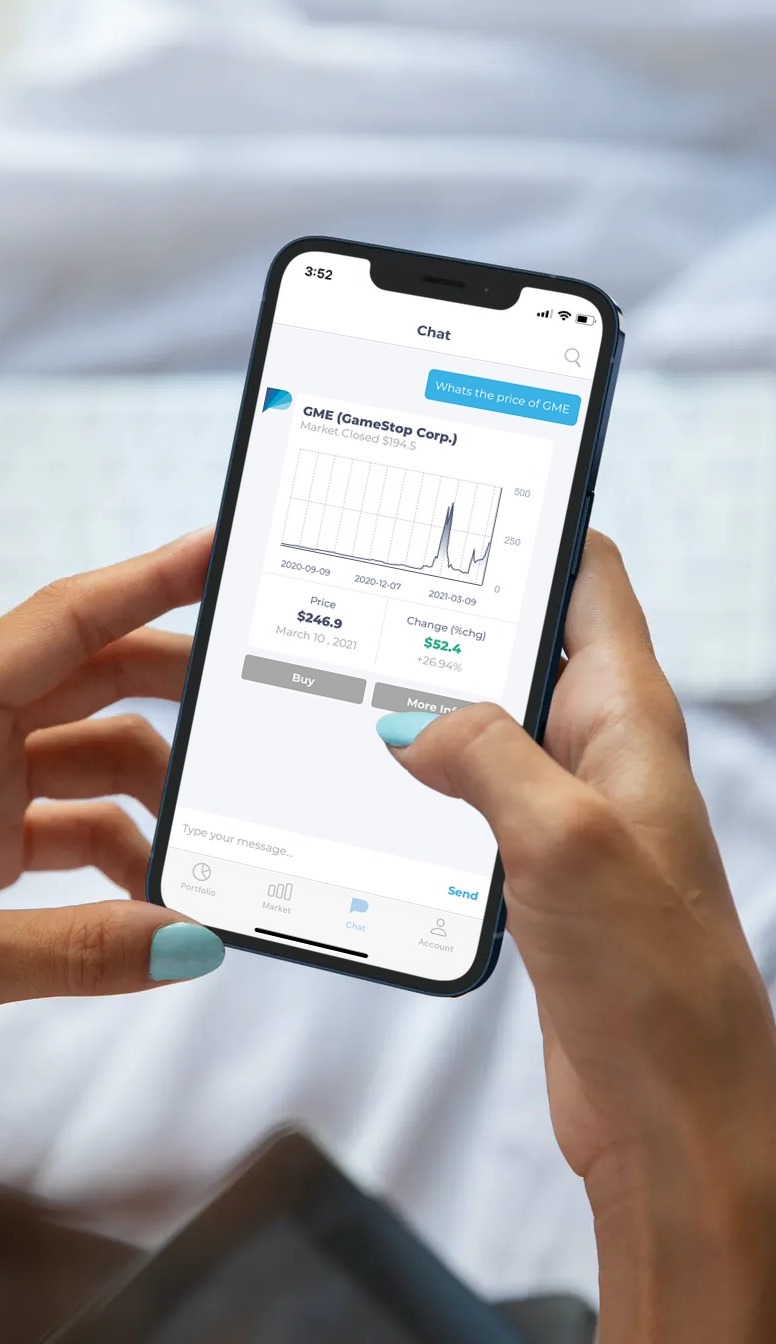

Access commission-free trading on 6,000+ US stocks, ETFs, and ADRs through our regulated brokerage affiliation.

Diversify globally. Trade locally. Invest intelligently.

Access the world's

largest stock market

Commission-free trading on thousands of securities from the world's most liquid exchange.

US Stocks

Trade all NYSE, Nasdaq, and Amex listed symbols with zero commissions.

- Entire US stock market

- Fractional share trading

- Real-time quotes

US ETFs

Choose from thousands of ETFs covering all asset classes and strategies.

- 6,000+ ETF options

- Halal-certified options

- ESG-screened funds

ADRs

Trade foreign companies listed on US exchanges directly from your account.

- International exposure

- US dollar pricing

- Easy diversification

Account Features

Built for Global Investors

USD Trading Account

Free, zero-commission brokerage account with no minimum balance

Fractional Shares

Invest any amount, even partial shares of expensive stocks

SIPC Insured

Up to $500,000 protection through Velox Clearing

Bank-Grade Security

256-bit encryption protecting all data and transactions

Seamless deposits

and withdrawals

Deposits

Instant by Card

Add funds to your account instantly using your debit or credit card.

Important: Account holder name on source account must match your Pasiv account name exactly.

Fees applicable based on account type

Withdrawals

Available Cash Only

Sell securities first; wait T+1 days for settlement before withdrawing.

Processing Time

Within 24 hours of request. Funds arrive in 24-96 hours via international wire.

Fee: $60 flat fee for each withdrawal (includes all wire fees)

May require bank statement verification for compliance

Trading Rules

You Should Know

Trade Settlement (T+1)

US securities settle on a T+1 basis. Funds take 1 business day to appear in your account after selling. You can buy with unsettled funds but must hold new positions through settlement.

Margin Accounts & Day Trading

Margin Rate

Fed Funds Rate + 6.5%

Position Margin Requirements

Long Positions - Initial

50%

Long Positions - Maintenance

30%

Short Positions - Initial

50%*

Short Positions - Maintenance

35%*

Volatile Stocks

35%*

New Issues / IPOs (30 days)

100%

2x Leveraged ETFs

60%

3x Leveraged ETFs

90%

* Not applicable for stocks priced below $5. Stocks below $5 require 100% initial and maintenance margin for shorting.

Day Trading Rules

A day trade refers to a purchase and sale of the same position (same symbol) within the same trading day. All investors have a maximum of 3 day trades allowed within a 5 business day time period in their regular account at zero commissions per SEC rules.

Standard Accounts: Pasiv will prevent you from day trading more than 3 times in a given 5 day window by default, helping you avoid violations.

Pattern Day Trader (PDT) Account: To day trade more than 3 times a week, you must deposit a minimum of $25,000 in your account and apply by emailing support@pasiv.ae. Day trading accounts are subject to volume-based commissions starting at $1 per trade and allow short selling. Suitability assessment required.

Day trading with margin involves risk, including potential loss of your capital. It is considered active trading and breaks from the ethos of passive investing. As such, it is meant for experienced traders only.

Ready to invest

like a professional?

Access all the tools you need for serious investing. No commissions, no minimums, no limits.